6 Challenges CFOs Could Solve with Robotic Process Automation (RPA)

Introduction

CFOs and finance executives are always looking to accelerate and increase efficiencies across finance and accounting functions so accountants can focus more on the risks and opportunities for the company. Streamlining operations equates to greater business agility to immediately identify when market turbulences occur then effectively respond and navigate to meet customer and shareholder demands.

With systems not evolving fast enough to meet the business needs, finance and accounting functions are required to accommodate these needs with manual work-arounds or by employing more resources. These events have opened the doors for new technology solutions to more rapidly adapt to business needs to accommodate changes without having to employ armies of staff on or off-shore.

In this article, we will explore Robotic Process Automation (RPA) and the benefits and opportunities CFOs must consider for transforming Finance and Accounting functions.

What is RPA?

In simple terms, Robotic Process Automation (RPA) is a computer software (aka “robot” or “Digital Worker”) that emulates the actions of a human interacting with a computer. RPA is best used to perform any manual task that is repetitive, easily defined, and high volume.

With RPA, digital workers replicate the mouse and keyboard functions of an employee but can go beyond the human interaction aspect and leverage more technological solutions, like running queries, calling APIs and Web Services, and conducting advanced analytics within the robot. Additional benefits of employing digital workers are the 24/7 work, ability to rapidly scale to meet demand, and flattening the peak demand from your financial close.

1. Streamlining business processes

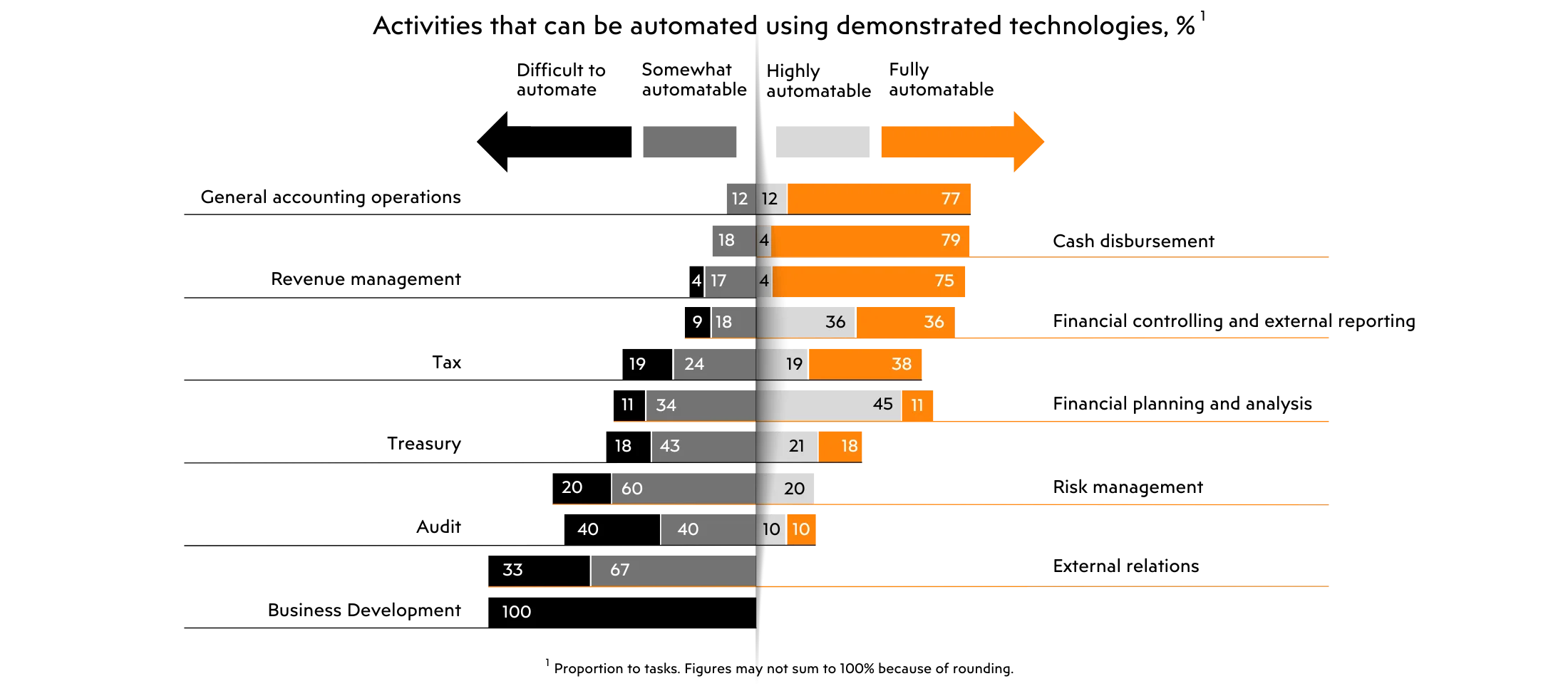

According to a report published by the McKinsey Global Institute, 42% of finance activities can be fully automated and an additional 19% can be mostly automated. RPA is good for simple tasks, like checking for FX rate changes, to complex processes, like reading bank statements for bank reconciliations. Other examples where RPA is often used are: Entry of sales orders, cash application, account reconciliations, vendor registration, purchase order creation, invoice registration, journal entry uploads, report retrieval, assembly, and preparation.

Imagine what you can do with over 50% of your finance and accounting processes automated effectively, efficiently, standardized, and with quality.

Related readings: Transforming the Finance Function with Automation

2. Improving productivity and reducing operational costs

The intent of RPA is to automate repetitive, standard, and manual low-value work. Employing robots streamlines business operations and returns hours to the business and enables employees to focus on higher-value tasks. Freeing up resources also enables employees to work on high priority projects that are often tabled because resources are only able to keep up with the volume of manual work.

Poor data quality costs businesses millions of dollars each year because employees will accommodate bad data and integrate work-arounds as part of their day-to-day work. Poor data quality will trickle through an organization, causing dependent processes to also accommodate the data issues. For example, unstructured vendor entry can cause additional lookups in procurement, invoice registration, cash application, and vendor reporting. RPA can be used to standardize data entry and validate data to ensure data quality at the acquisition point of the data.

Accurate and standardized data means faster processing which translates to faster report generation, which accelerates Close, Financial Analysis, Analytics, and more.

Processes automated with RPA can also be repurposed to support time-consuming system upgrade projects that tie up your most knowledgeable resources with user acceptance testing.

Related readings: RPA can fix your data quality issues

3. Reducing operational risk (aka Enable your team to excel, not Excel)

Does your organization have to certify an Excel workbook, as a system of record? Does your F&A team specialize in complicated macros and formulas? Are you at risk of a key-man dependency because someone on the team built a complex macro-laden, formula powered, cross-referencing data behemoth of an Excel workbook?

RPA is a great way to eliminate End User Tools (EUT/EUC) and the risk of corrupted Excel files. RPA also ensures that the same steps are always completed the same way, which eliminates the risk of an accountant not refreshing a lookup table or retrieving the most up-to-date results. RPA processed data will be standard, consistent, documented, and auditable.

4. Scale operations to meet growing demands

Processes automated with RPA can return a significant number of hours back to your business, which enables team members to refocus on what is important, such as identification of risks, errors, and opportunities. Standardizing processes also enable the automated process to scale in the event of higher transaction volumes or seasonality, which reduces costs associated with hiring (FTE or temp workers).

Be aware that most RPA practitioners want to automate accounting tasks based on an individual’s user requirements, which is not scalable and cannot also automate comparable functions across Finance and Accounting teams. Our extensive experience supporting finance and accounting functions helps us to identify automation components that can be repurposed across a multitude of processes, which not only helps to speed up automation deployment, but also establishes standards and consistency in processing.

5. Optimizing key performance indicators (KPIs)

A big challenge we often see when automating finance and accounting departments is that most companies do not have any metrics to support where employees spend their time, processing times, or volumes. The implementation of RPA enables organizations to drill into the details on how teams are utilizing their time. We often see a lot of inefficiencies in manual business processes, so we use the captured information to reengineer the process for automation to ensure that the processes run more efficient and effectively.

RPA also enables the tracking of processes for volume counts, average processing times, processing costs, and exceptions. Isolating and analyzing exceptions can further improve process efficiencies, but it requires operational metrics to understand how well the processes are being executed.

Related readings: Understanding benefits realization with RPA

6. Ensuring compliance requirements are being met

RPA is effective for supporting and ensuring compliance across your organization. RPA ensures greater compliance since the defined actions within an automated process are always executed in a consistent manner with more accuracy and higher quality. This ensures greater compliance across all business processes.

RPA also improves oversight and auditability, because a Digital Worker’s defined actions are captured during execution into an audit log for monitoring and auditing, which simplifies operations and enables compliance concerns to be addressed more quickly. The log is also helpful in troubleshooting processing issues.

Conclusion

With the job requirements of CFOs to be more focused on the company’s viability, long-term growth strategies, short-term crisis navigation, and managerial decision-making, there is less time for focusing on the day-to-day functions. Leveraging RPA will help free your staff from the low-value tasks and functions to create business agility by transforming and reshaping the finance function from number crunchers into data-driven, strategic partners your business needs.

Azure Cloud Services – Design, Migrate, Manage & Optimize

Our highly skilled Microsoft team help customers in defining their cloud strategy, objectives, and next steps to perform a risk benefit analysis of moving applications to the cloud. We help customers to take a workload-centric approach.

Please write to info@vigilant-inc.com or fill the form below: