Transforming the Finance Function with Automation

With rapid market shifts forcing the need for business agility, CFOs are being pressured to reinvent their finance and accounting teams from number crunchers into THE competitive advantage for their company. Before the digital revolution, finance leaders could only throw more bodies at the problem areas, but now businesses can employ armies of digital workers to execute business tasks and processes with speed, efficiency, consistency, and quality.

Digital Workers are the “Robots” in Robotic Process Automation (RPA). With RPA, digital workers replicate the mouse and keyboard functions of an employee but can go beyond the human interaction aspect and leverage more technological solutions, like running queries, calling APIs and Web Services, and conducting advanced analytics within the robot. Additional benefits of employing digital workers are the 24/7 work, their ability to rapidly scale to meet demand and flattening the peak demand from your financial close.

What processes and tasks can I automate?

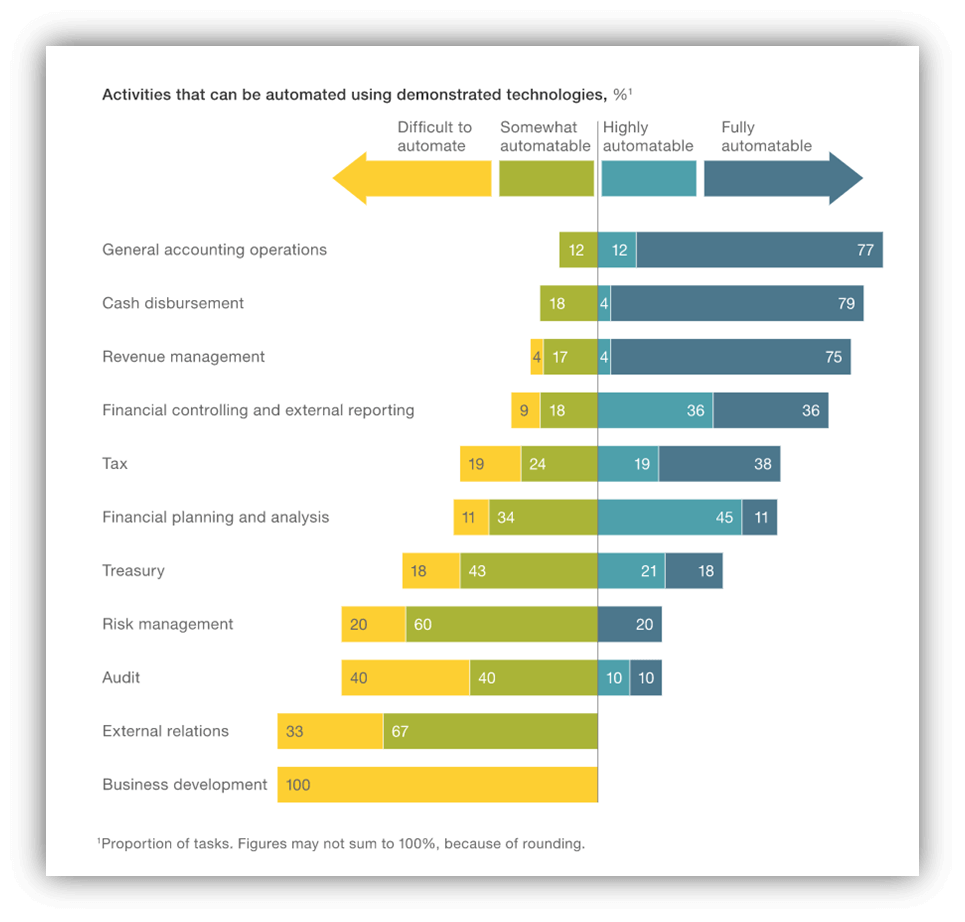

According to a report published by the McKinsey Global Institute, 42% of finance activities can be fully automated and an additional 19% can be mostly automated. RPA is good for simple tasks, like checking for FX rate changes, to complex processes, like reading bank statements for bank reconciliations. Other examples where RPA is often used can be: Entry of sales orders, cash application, account reconciliations, vendor registration, Purchase Order creation, invoice registration, journal entry uploads, report retrieval, assembly, and preparation.

It is also important to understand that RPA is effectively the entry point for Artificial Intelligent (AI) technologies, so RPA can engage more advanced technologies like OCR and Machine Learning for the reading of invoice documents of a supplier, extracting the information, and registering the invoice into your AP system. RPA can also be for engaging AI to support analytic models in forecasting process.

The following is a simple way to think about where to employ RPA:

- Rule-based

- Easily described

- High transaction volumes

- Low exceptions

- Stable and well-defined processes

- Low system change

- Structured data and readable electronic inputs

- Are people passionate about the process?

Examples where we have used automation in Finance and Accounting:

Financial Control & Reporting

Credit-to-Cash (AR)

Procure-to-Pay (AP)

Financial Planning and Analysis (FP&A)

Cash & Treasury Management

Payroll

Financial Control & Reporting

- Journal Entry Creation and Upload/Entry

- Account Reconciliation

- Report Assembly and Preparation

Credit-to-Cash (AR)

- Enter Sales Orders

- Credit Checks

- Customer Follow-ups

- Retrieve Cash from Bank

- Cash Application / Allocation

Procure-to-Pay (AP)

- Vendor Registration

- Create Purchase Order

- Invoice Registration

- 2/3 way matching

- Payment (Batch) Creation

- Payment Issuance

Financial Planning and Analysis (FP&A)

- Retrieving reports from internal/external sources

- Standardizing and cleansing data

- Consolidating datasets

- Building standard report outputs and populating PowerPoints

Cash & Treasury Management

- Generate Daily Cash Positions

- Cash Forecasting

- Bank Account Analysis

Payroll

- Time-sheet coding validation

- Run payroll

- Calculating deductions

- Auditing reported hours against schedule

When over 50% of your finance and accounting processes are automated, finance functions can focus on the risk identification, business analysis, forecasting, and analytics to accelerate data-driven decision making. With efficient process automation you can transform your finance function.

Related readings:

Author:

Joshua Gotlieb

Intelligent Automation Practice Director, Vigilant Technologies