Cloud migration in the Cloud Adoption Framework

Introduction

Any enterprise-scale cloud adoption plan will include workloads that do not warrant significant investments in the creation of new business logic. Those workloads could be moved to the cloud through any number of approaches: lift and shift; lift and optimize; or modernize. Each of these approaches is considered a migration.

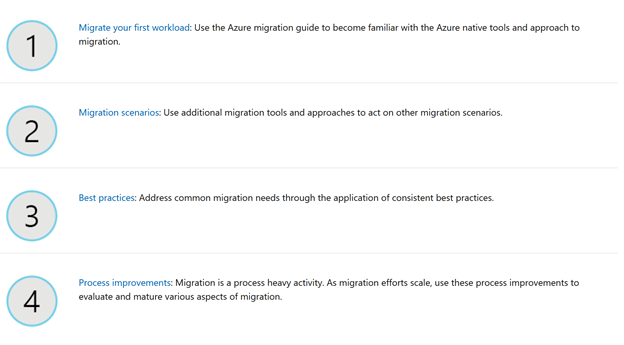

The below steps will help establish the iterative processes to assess, migrate, optimize, secure, and manage those workloads.

To prepare you for this phase of the cloud adoption lifecycle, Vigilant Technologies recommend the following:

The Migrate methodology and the steps above build on the following assumptions:

- The methodology governing migration sprints fits within migration waves or releases, which are defined using the Plan, Ready, and Adopt methodologies. Within each migration sprint, a batch of workloads is migrated to the cloud.

- Before migrating workloads, at least one landing zone has been identified, configured, and deployed to meet the needs of the near-term cloud adoption plan.

- Migration is commonly associated with the terms lift and shiftor rehost. This methodology and the above steps are built on the belief that no datacenter and few workloads should be migrated using a pure rehost approach. While many workloads can be rehosted, customers more often choose to modernize specific assets within each workload. During this iterative process, the balance between speed and modernization is a common discussion point.

Migration effort

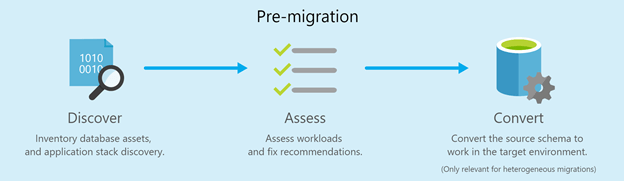

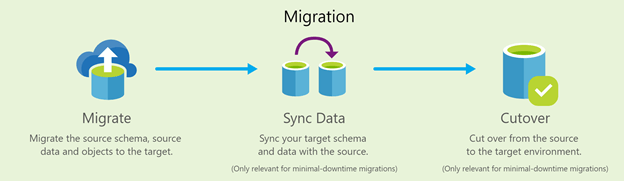

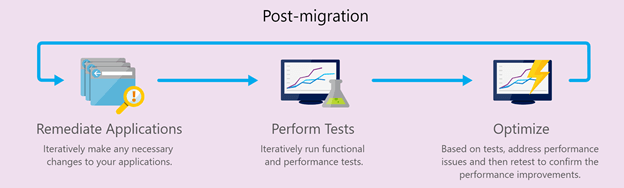

The effort required to migrate workloads generally falls into three types of effort (or phases) for each workload:

- Assess workloads,

- Deploy workloads,

- and release workloads.

In a standard two-week long iteration, an experienced migration team from Vigilant Technologies can complete this process for 2-5 workloads of low-medium complexity.

More complex workloads, such as SAP, may take several two-week iterations to complete all three phases of migration effort for a single workload. Experience and complexity both have a significant impact on timelines and migration velocity.

Migration waves and iterative change management

Migration iterations deliver technical value by migrating assets and workloads. A migration wave is the smallest collection of workloads that deliver tangible and measurable business value. Each iteration should result in a report outlining the technical efforts completed.

Next steps

The steps outlined above can help you develop an approach to improve processes within each migration sprint. The approach at Vigilant Technologies can ensure that common tools and approaches needed during your first migration wave will render a successful result.

Read more about Vigilant’s Azure Cloud Migration Services

Author:

Stephen Clark

Principal – Technology Strategist, Vigilant Technologies